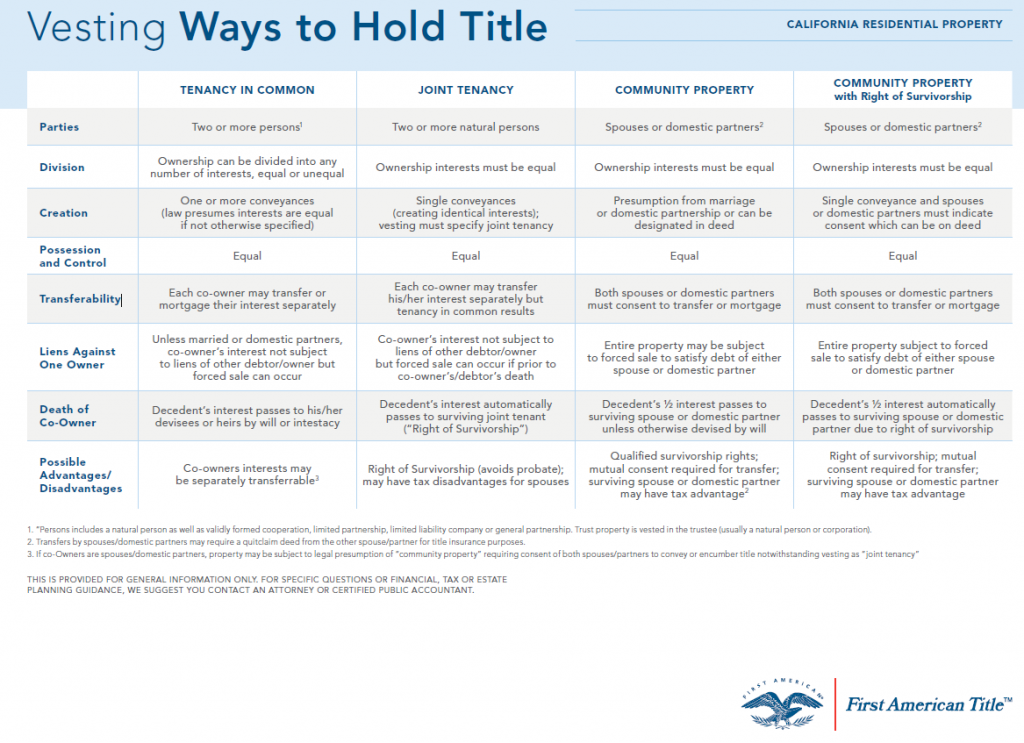

Vesting Ways to Hold Title

California Residential Property

TENANCY IN COMMON JOINT TENANCY COMMUNITY PROPERTY COMMUNITY PROPERTY

with Right of Survivorship

Parties Two or more persons1 Two or more natural persons Spouses or domestic partners2 Spouses or domestic partners2

Division Ownership can be divided into any

number of interests, equal or unequal Ownership interests must be equal Ownership interests must be equal Ownership interests must be equal

Creation

One or more conveyances

(law presumes interests are equal

if not otherwise specified)

Single conveyances

(creating identical interests);

vesting must specify joint tenancy

Presumption from marriage

or domestic partnership or can be

designated in deed

Single conveyance and spouses

or domestic partners must indicate

consent which can be on deed

Possession

and Control Equal Equal Equal Equal

Transferability Each co-owner may transfer or

mortgage their interest separately

Each co-owner may transfer

his/her interest separately but

tenancy in common results

Both spouses or domestic partners

must consent to transfer or mortgage

Both spouses or domestic partners

must consent to transfer or mortgage

Liens Against

One Owner

Unless married or domestic partners,

co-owner’s interest not subject

to liens of other debtor/owner but

forced sale can occur

Co-owner’s interest not subject to

liens of other debtor/owner

but forced sale can occur if prior to

co-owner’s/debtor’s death

Entire property may be subject

to forced sale to satisfy debt of either

spouse or domestic partner

Entire property subject to forced

sale to satisfy debt of either spouse

or domestic partner

Death of

Co-Owner

Decedent’s interest passes to his/her

devisees or heirs by will or intestacy

Decedent’s interest automatically

passes to surviving joint tenant

(“Right of Survivorship”)

Decedent’s 1/2 interest passes to

surviving spouse or domestic partner

unless otherwise devised by will

Decedent’s 1/2 interest automatically

passes to surviving spouse or domestic

partner due to right of survivorship

Possible

Advantages/

Disadvantages

Co-owners interests may

be separately transferrable3

Right of Survivorship (avoids probate);

may have tax disadvantages for spouses

Qualified survivorship rights;

mutual consent required for transfer;

surviving spouse or domestic partner

may have tax advantage2

Right of survivorship; mutual

consent required for transfer;

surviving spouse or domestic partner

may have tax advantage

1. “Persons includes a natural person as well as validly formed cooperation, limited partnership, limited liability company or general partnership. Trust property is vested in the trustee (usually a natural person or corporation).

2. Transfers by spouses/domestic partners may require a quitclaim deed from the other spouse/partner for title insurance purposes.

3. If co-Owners are spouses/domestic partners, property may be subject to legal presumption of “community property” requiring consent of both spouses/partners to convey or encumber title notwithstanding vesting as “joint tenancy”

THIS IS PROVIDED FOR GENERAL INFORMATION ONLY. FOR SPECIFIC QUESTIONS OR FINANCIAL, TAX OR ESTATE

PLANNING GUIDANCE, WE SUGGEST YOU CONTACT AN ATTORNEY OR CERTIFIED PUBLIC ACCOUNTANT.

Vesting Ways to Hold Title